News

News

Beauty and home care growing during the crisis

Growth despite adversity

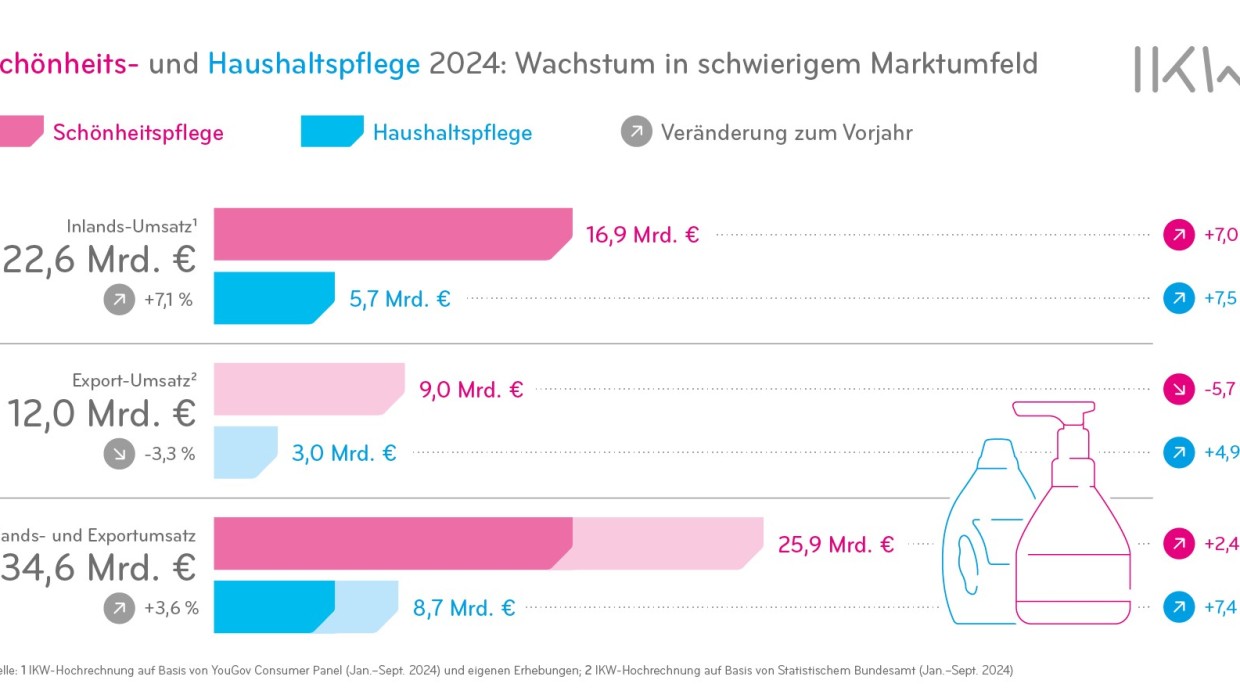

The high demand for cosmetics and household care products continued unabated in Germany in 2024 - despite the weak economic situation and increased burdens. Retail sales of these products even increased by 3.6 per cent to 34.6 billion euros, according to the German Cosmetic, Toiletry, Perfumery and Detergent Association (IKW) based on projections. Domestic sales grew by more than seven per cent to 22.6 billion euros, while export sales fell to twelve billion euros. However, high costs and increasing bureaucracy are limiting the scope for investment and threatening the competitiveness of the industry, which is characterised by medium-sized companies.

Top-selling cosmetics

Despite consumer restraint, beauty care products held their own with an increase in turnover of seven per cent to almost 17 billion euros. Decorative cosmetics in particular, such as lipstick, concealer and mascara, recorded growth of ten per cent to 2.2 billion euros, followed by dental care products with an increase of a good nine per cent to almost two billion euros. Fragrances accounted for just under 2.1 billion euros. Hair care products, the category with the highest sales, also grew significantly once again to 3.8 billion euros. ‘In times of crisis, a well-groomed appearance and personalised styling are particularly important for consumers,’ said IKW Chairman Georg Held. At the same time, the household care products segment grew by more than seven per cent to 5.7 billion euros. Fabric softeners even grew by more than 22 per cent, and heavy-duty and colour detergents by almost ten per cent.

Drugstores are the most important sales market

German consumers continue to buy most of their cosmetics in drugstores: Their market share is 52 per cent, followed by specialist retailers and the growing e-commerce sector. Drugstores also dominate the market for household care products, but discounters and supermarkets also play an important role. Meanwhile, the industry's foreign business was down on the previous year at twelve billion euros. While beauty care had recently boosted exports, exports of cosmetics fell to nine billion euros. Household care products, on the other hand, recorded an increase to three billion euros.

Industry under heavy strain

However, the economic challenges for IKW member companies have become even more acute. According to an IKW survey, more than half of the companies see themselves under considerable pressure from rising energy prices and labour costs as well as inflation, new taxes and legal uncertainties. Additional notification and reporting obligations, for example as a result of the EU's ‘Green Deal’ and supply chain requirements, are also curbing companies' room for manoeuvre and willingness to invest. Nevertheless, the industry is expecting sales growth of 2.3 per cent this year. The Personal Care and Detergents Industry Association represents more than 440 companies, covering 95 per cent of the market.

Source: IKW